Older (Fall 2013) - Spring Edition Coming May 2014!

Winter 2014 Newsletter

Volume 11; Issue 1

First of all, welcome to Trinity Wealth Partners’ new edition of our quarterly newsletter; with a new year comes a new look for our print edition. You can expect some changes to the online edition in our next issue. We, of course, welcome your feedback on the design and content of our newsletters, for this new edition and all issues, past or present. Our goal is not only to inform you of important news in the industry and markets, but to capture your interest and develop your desire to keep on top of your investments and financial plan on a regular basis. Events like changes in the Canadian dollar can affect the value you get out of your vacation, and advances in technology can throw a wrench in your estate plan. Keeping informed on these kinds of events and how they affect your financial plan can help you, and your plan, stay current, relevant, and effective.

In other news, Rick, Erin, Jacob, and Lily welcomed a new baby girl on November 25th, 2013. Sylvie Rose has been keeping ours truly on his toes (sometimes a little too early in the morning) and, with the love of her adoring older sister and brother, is a happy addition to the Irwin family.

We are now into the height of RRSP and TFSA season! The RRSP deduction deadline for the 2013 tax year is March 3rd; as of January 1st, 2014 Canadian citizens now have an additional $5,500 of contribution room available for their Tax-Free Savings Accounts. With these investing opportunities and the potential of the market for 2014, now may be the time to give us a call!

Market Watch

Stock markets soared in the fourth quarter of the year, capping off what was a solid year for most markets. There was quite a divergence in returns between regions and between sectors however; it was not a rising tide lifting all ships.

The US stock market experienced one of the strongest returns it has seen since the 1990s; up nearly 30% in Canadian dollars. This despite the fact that a year ago the media was calling for the U.S. to post weak growth, and possibly even fall into recession, due to the implementation of automatic budget cuts. Most major developed markets followed suit with the growth, with strong gains in Japan and parts of Europe.

Bonds suffered as the threat of rising interest rates, which are generally negative for bonds, spooked investors. The Emerging Markets, led by China, posted weak returns with the Emerging Markets region down about 6% as investments flowed out of these regions and into the U.S. and Europe.

Canada was a tale of two cities as anything non-energy or materials did quite well but those sectors dragged the TSX down so it returned less than 9% overall; much less than the robust gains experienced elsewhere. Last but not least, there was a large sell off in gold earlier in the year. On a sector basis, health care, technology and consumer stocks did particularly well; not areas that Canada has a large footprint in. It is expected by many investment professionals that Canada will lag again this year, though not to the same degree as it has in the past.

All in all, it was a very good year to have a diversified portfolio! If you were concentrated in the wrong things, you really missed out. It’s impossible to predict what will do the best, however, so diversification is still very important, as is, in my opinion, selecting managers with the ability to move around as conditions unfold. Global risks have not gone away however so it is still important to have some defensive strategies in place.

So what does the future hold? Some of the major trends that really took hold last year such as a flight out of commodities and emerging markets and into global consumer stocks and the U.S., are expected to continue. Markets rose quite steadily for most of last year and there is a strong possibility of a typical correction at some point this year.

The resiliency of this latest stock market is encouraging and there has been a strong flow of funds out of bonds and into stocks which, if it continues, could continue the momentum of positive returns, although probably not at quite the pace of what we saw last year.

Active Portfolio Management

Growth as an investing style has been more or less out of favour for thirteen years. Recent signals indicate that the pendulum could finally be swinging back in favour of growth.

For years there has been a vigorous debate between the merits of “passive” investing, using low cost investment vehicles that closely follow the overall movement of the markets, and the use of active managers who try to add value through stock selection and asset allocation decisions.

Increasingly, evidence has shown that truly active managers have outperformed passive strategies. A recent study featured in Dynamic Funds’ Advisor magazine1 showed that truly active managers beat their benchmarks by 1.3% annually, net of fees and expenses.

Some encouraging signs for active managers are a renewed interest on the part of investors for growth stocks or small caps, which historically do the best in a rising interest rate environment. Already the more cyclical names, such as technology, are performing well while the more defensive sectors like utilities have lagged; which is counter to more recent trends.

Another important development is the breakdown in inter-stock correlation. For the last several years stocks were correlating as high as 90% of the time, meaning that they rose and fell more or less together. Since June that level has dropped to between 30-40%, meaning that individual stocks are behaving differently, providing a greater opportunity for active managers to add value. This is the type of environment where stock pickers thrive. The key is to select those truly active managers from those who are rising the market wave, as the divergence in performance will likely be greater than it has been in recent years.

Our Canadian Dollar

2014 has started off with our Canadian Dollar’s value continuing to decrease and it’s at it’s lowest level since September, 2009.

This recent four year low came just the day after the Bank of Canada announced it would hold the benchmark interest rate steady at 1% as inflation for 2013 was lower than anticipated.

Many experts have felt that our Canadian dollar has been overvalued for some time and that there will be continued pressure to keep our dollar low for some time.

A lower dollar could have a positive impact on our economy by boosting exports, increasing tourism, and manufacturing. On the flip side, it also makes things much more expensive for us as consumers and dampens our travel plans as travelling to all destinations outside of Canada are impacted by the currency exchange and our weak dollar.

The U.S. market certainly surpassed Canada’s major index in 2013 and many of the investments you are in likely have holdings in the United States.

Some of the Canadian Equity Fund managers we have partnered with have gradually increased the foreign content in their funds to hold U.S. Equity as a part of a diverse portfolio, to capture better opportunities outside of our borders. More recently, some Canadian Equity funds have close to 50% (or the maximum allowable) foreign content within their holdings.

So how does this dollar performance affect your U.S. investments?

When the Canadian dollar appreciated relative to the U.S. dollar between 2003 and 2007, Canadian investors with unhedged U.S. equity exposure saw the value of their investments (in Canadian dollars) decline.

When our dollar is weaker, investing in the U.S. should give us a greater return as you gain both the investment return as well as the currency differential since your investments are made with Canadian dollars.

Keep in mind, fund managers hedge currency in different ways depending on the funds you hold. Some hedge the currency fluctuations at all times, other never hedge and just let the currencies float freely, while other use an active hedging policy where the amount being hedged varies depending on the current exchange rate.

2014 Tax Measures and Rates

In a round of good news from Ottawa, the small business corporate tax rate will decrease, and a new tax credit is available for seniors.

In 2014, the CPP maximum earnings will increase to $52,500 with the normal basic exemption of $3,500. The contribution rate will remain at 4.95% for an annual maximum of $2,425.50 which is an increase of $69.30 over last year or approximately 2.95%.

The Employment insurance contribution rate has increased from 1.88% to 1.92% and the annual maximum Employee contribution is $913.68 for 2014.

Effective January 1st, 2014, the current 3.5% small business corporate income tax rate and $400,000 small business threshold will decrease to 3% and $350,000 respectively.

Seniors with a taxable income under $24,000 may claim a new non-refundable tax credit calculated at their lowest personal tax rate (i.e.; 8.79%) on an age amount of $1,000.

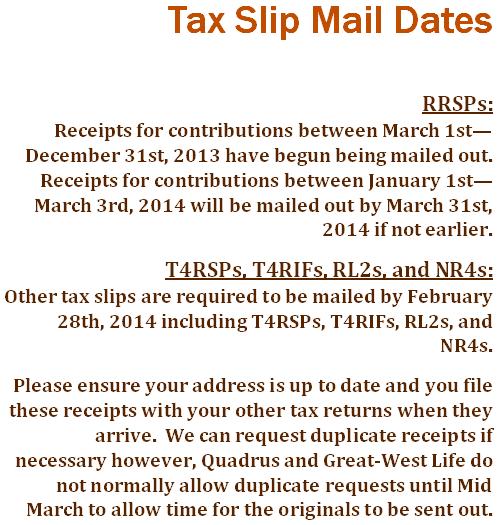

We highly recommend that you begin getting your tax slips and deductions together as the April deadline is fast approaching. It will certainly ease the stress of tax time if you’re prepared!

You have up until March 3rd, 2014 to contribute into an RRSP for the 2013 tax year.

If you would like to discuss the option of an RRSP loan or your tax situation, kindly give our office a call and we can review your tax situation with you.

Are You Subject to U.S. Estate Tax?

The estate tax is based on the fair market value of all U.S. assets owned at the time of death. It can reach 40%, depending on the value of U.S. assets and the worldwide estate.

But not all Canadians who own U.S. assets will be subject to U.S. estate tax. A look at the new tax rules will help you determine whether you’re exposed.

New U.S. estate tax rules

On January 2, 2013, the American Taxpayer Relief Act of 2013 was signed.

Your U.S. estate tax liability now depends on the answers to the following two questions:

- Is the value of your U.S. estate more than $60,000?

- Is the value of your worldwide estate greater than $5.25 million?

If the fair market value of U.S. assets is less than $60,000 on the date of death, then there is no U.S. estate tax. If the value of U.S. assets on death exceeds $60,000, you may still be exempt if the value of your worldwide estate upon death is less than $5.25 million.

Everything counts when calculating your worldwide estate — including RRSPs and life insurance. And if you’re married, it’s important to calculate the value of your spouse’s estates as well.

What are U.S. assets?

Here’s a complete list of U.S. assets subject to U.S. tax.

- Real estate property located in the U.S.

- Certain tangible personal property located in the U.S., such as furniture, vehicles, boats and airplanes

- Golf club equity memberships

- Shares of U.S. corporations, regardless of the location of the share certificates (even inside RRSPs or RRIFs)

- Interests in partnerships owning U.S. real estate or carrying on business in the U.S.

- U.S. pension plans and annuity amounts (IRAs and 401K plans)

- Stock options of a U.S. company (public or private)

- U.S. mutual funds

- Money owed to Canadians by American persons

- Money market accounts with U.S. brokerage firms

The following is a list of U.S. assets not subject to U.S. estate tax.

- U.S. bank deposits

- Certain debt obligations, such as U.S. government bonds

- American depository receipts

- Term deposits/guaranteed investment certificates

- Real estate situated outside the U.S

- Canadian mutual funds denominated in U.S. dollars that invest in U.S. stocks

- Life insurance proceeds payable on the death of a Canadian citizen and resident who is not an American citizen

- Non-U.S. stocks, bonds and mutual funds

To reduce your tax liability, consider an alternative ownership structures for some of your U.S. holdings, such as corporations, cross-border trusts, or limited partnerships. These structures avoid probate and guardianship proceedings in the case of incapacity.

As for any U.S. stocks you hold, consider selling or creating a Canadian holding corporation so you can transfer the stocks on a tax-free basis.

There are a variety of strategies that can protect you from the new rules. But first, determine whether you’re exposed.

Digital Estate Planning

Changes in the way we use technology to manage our lives, means changes in the way we must plan for our estates. From computer passwords to online banking, all factors should be included in your estate plan.

We all know how important it is to have a plan for your physical estate at the time of your death, including property, heirlooms, and financial assets. Many people, however, overlook their digital assets. More and more of what could be considered “digital property” is housed somewhere on your home computer or “the cloud”, including gigabytes of bills, tax documents, pictures, and receipts. In an effort to stay green, many of us no longer keep hard copies of these items, but this can make it much more difficult for your family to manage, or even access your digital estate.

A key part of your digital estate is the password you use to protect it. Many of us hesitate to write these down, but when it comes to planning for your death, keeping a record may be necessary. An alternative would be to express where your passwords can be found, rather than directly including them in your will.

Passwords become less helpful if your family members aren’t even able to identify all of the accounts you hold. It may be a good idea to keep a list of important accounts, banking or otherwise, that your family should be able to access. Some other accounts might include your email, social media accounts (Facebook, Twitter, etc.), online file storage (Dropbox, Google Drive, etc.), or desktop user accounts. Your smartphone may also be included if you use a password (or “lock screen”) to gain access to it.

In your day-to-day activities, keep in mind the accounts you use and whether or not your family might need access to them after your death. If so, plan for it!

Follow us on Twitter!

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Insurance products, including segregated fund policies are offered through Trinity Wealth Partners Inc., and Rick Irwin offers mutual funds through Quadrus Investment Services Ltd.

The information provided is based on current tax legislation and interpretations for Canadian residents and is accurate to the best of our knowledge as of the date of publication. Future changes to the tax legislation and interpretations may affect this information. This newsletter contains general information only and is intended for informational and educational purposes provided to clients of Rick Irwin, CFP, CLU. While information contained in this newsletter is believed to be reliable and accurate at the time of printing, Rick Irwin does not guarantee, represent or warrant that the information contained in this newsletter is accurate, complete, reliable, verified or error-free. This newsletter should not be taken or relied upon as providing legal, accounting or tax advice. Prospective investors should review the offering documents relating to any investment carefully before making an investment decision and should ask their advisor for advice based on their specific circumstances. You should obtain your own personal and independent professional advice, from your lawyer and/or accountant, to take into account your particular circumstances. Quadrus Investment Services Ltd. and design, Quadrus Group of Funds and Fusion are trademarks of Quadrus Investment Services Ltd. Used with permission.