Older (Winter 2013) - Newer (Summer 2013)

Spring 2013 Newsletter

Volume 10; Issue 2

First of all, I’d like to welcome you to the first newsletter of “Trinity Wealth Partners”, our new corporate brand. The format has changed slightly but overall we are still aiming to bring you content that covers the various areas that impact comprehensive wealth management; investments, taxation, debt management, retirement income planning, insurance and estate planning. With frequent changes to taxation and government benefits, global events affecting markets on a daily basis, and new innovative products to manage risks, there is usually no shortage of subjects to address but if you have any areas you’d like us to cover off, or have any comments or feedback, please do not hesitate to drop us a line!

Market Watch

2013 is off to a strong start from the perspective of global financial markets. The so-called “fiscal cliff” came and went and the US economy is showing increasing signs of strength. The rebounding US housing market, the potential global game changer of the US becoming a net exporter of oil, and a general sense that the US market is undervalued given return expectations for other assets like bonds have all contributed to the positive sentiment. The most important factor affecting the US market is the continued strength of the expanding middle class consumer base in Asian, led by China and their appetite for Western brands. The US is chock full of consumer luxury and staple companies that are benefiting enormously from the rise of the Asian middle class.

Recent events in Europe (the most recent trigger being tiny Cyprus) have reminded investors that we are not out of the woods yet when it comes to the enormous debt levels that governments have amassed both through years of overspending and the fallout of the global financial crisis. But on average, global growth is actually quite strong and the future potential is very robust if we consider the demographics of the world’s most populous nations. The McKinsey Global Institute, a renowned global economic think-tank and government foreign policy consultant, has recently issued a report that states we are a crossroads in human history; the number of people on the planet who are part of the middle class will soon, for the first time ever, exceed the number of poor. Estimates put the number of people who will have achieved middle class status by 2025 in excess of 5 billion; close to double today’s levels. That continued demand will benefit US and other companies with strong global brands and the rising profits of these companies should produce favourable returns for investors. Overall the fund managers I have spoken with are optimistic about the prospects going forward, especially for the US market which has under-performed Canada for over a decade.

Managing Your Debt

Most of us have debt with the goal of becoming debt free down our path in life. As a Financial Security Advisor, I cannot stress how important managing your debt is. A savings of 0.5% to 1% on an interest rate on a big ticket item such as a mortgage is HUGE over the amortization period of your mortgage. It’s so important to pay attention to the interest rates you’re paying and I highly recommend using brokers for this purpose or to shop the rates yourself. My experience tells me that unfortunately, many people don’t shop rates and they believe their bank is giving them the best rate. The banks are like the cable companies! Unless you threaten to pull your business you’re often not getting the best offer out there. It’s actually sad that we as consumers have to play this game to get the best rate. I’m not saying everyone has too, but in general it’s the whole “you won’t get it unless you ask for it”.

I feel understanding your credit score and your debt to income ratio is important when applying for such loans or better interest rates. If you have excellent creditor and/or a good debt ratio if should give you the confidence you need to negotiate a better rate as lenders want YOUR business!

The debt to income ratio is often brought up when applying for loans such as a mortgage, line of credit or auto loan as this ratio determines how much debt you can “handle”. Most of the major lenders consider a healthy debt to income ratio 30% or less. If you are bordering the 40% range it raises a big red flag to lenders. If your debt ratio is close to or above 40% I highly recommend you get help because you’re considered a vulnerable household and you don’t have any breathing room if interest rates rise.

Simply put, this calculation takes your gross monthly income (not net) and, if applicable, your spouse’s monthly income. Then you add up all of your debt payments such as a mortgage, credit card, line of credit payment, student loan, etc…) Divide your total monthly debt payments by your monthly income, multiply by 100 and you have your debt-service ratio.

If you calculate your score and are worried your ratio is too high, call our office and we can look at your overall financial health by not only looking at your investments but looking at your debt and working with you to find solutions to put you back on track.

Company News

As some clients already know, there is a new face at the front desk at Trinity Wealth Partners. I, Natalie, joined Melissa and Rick at the beginning of March as an Administrative and Marketing Assistant, and it’s hard to believe that over a month has gone by already! A big part of my position is keeping in contact with you, our clients, so you can expect my voice on the phone or notes in an email.

The second significant portion of my position is marketing: newsletters, email campaigns, social media, our website, and public relations are all included. With that have come a new, more email-friendly format for our e-newsletter and an updated design for the print edition. Our new newsletter program also allows us to email you, our clients, more frequently with important updates about the company and the markets. We have also made some improvements on our website, including more recent videos in the library, a newsletter subscription page, and more accessibility: for those who may have found the text a bit too small to read, there are now controls to adjust the size. Finally, our Twitter account is alive and well: @WealthTrinity. Follow us!

Some of our ideas, including the text size modifier, come from our fantastic clients. We absolutely welcome your feedback on our website, our newsletter, and anything else that catches your eye; positively or critically. I very much look forward to meeting those who I haven’t already met over the next few months!

Impact of Federal Budget Changes

The recent Federal budget proposed several changes that will have an impact on the financial services industry:

Dividend Taxation

First of all, the government has announced that they will be altering how they tax dividends paid from self employed income, with the effective personal tax rate on these dividends increasing by approximately 2 percent. Their goal in this regard is to “level the playing field” between business owners or other self employed individuals who choose to pay themselves salary vs. those who choose to pay themselves dividends. In nearly all provinces, and in nearly all tax brackets, there is currently an advantage to pay dividends vs. salary (anywhere from 1-4% depending on the province and the tax bracket.) This change will close that gap, making it less advantageous for self employed individuals to pay themselves dividends. I obviously think this is a negative but it’s not as much of a game changer as it seems at first. The use of a corporate structure still allows significant deferral of tax if the income is not needed for personal use in the year that it is earned. It’s only when the dividends are paid out personally that the second level of tax is incurred and the tax “integration” between salary and dividends kicks in. If the after-tax corporate income (85.5 cent dollars in Nova Scotia) is invested in the company, or a related Holding Company, significant tax deferral, and savings, is still possible. Other considerations are paying into CPP as a self employed individual (2x the amount that an employee pays), the tax treatment of RSPs versus capital gains and dividends in retirement etc. The advantage of dividends has been diminished by this tax increase on the self employed, especially if you need to pay yourself all the income the company earns regardless of salary or dividends, but it has not been eliminated.

Character Conversions

Second, they have announced that they are going to be disallowing "character conversions" which is a clever mechanism by which mutual fund companies use "swap" contracts to convert otherwise fully taxable income like interest on bonds or foreign dividends to capital gains. Capital gains are taxed at half the rate of regular income and many mutual funds have been structured in this way which has been a huge benefit for corporate and other non registered investors. The net result is that the funds that have been structured in this way will lose the ability to convert higher tax investment income to lower tax capital gains and investors in non registered accounts will pay more tax as a result. It doesn’t apply to RSPs as all taxes are deferred until the funds are withdrawn and everything withdrawn is fully taxable as income. It does offer some tax planning opportunities as investments that deliver a high level of income (foreign dividends or high interest bonds) should be considered to be held in TFSAs where there are no tax consequences or in RSPS or RRIFs where the tax treatment is the same regardless.

Testamentary Trusts

Another potential negative development is the announcement that they are going to be investigating the use of testamentary trusts in estate planning. Testamentary trusts are special trusts that are created via the wording of a will. Unlike regular trusts, which are taxed at the highest personal rate, testamentary trusts have the same graduated tax rates as an individual, thereby allowing future investment income and gains to be potentially taxed at lower rates than if the money had been inherited personally where the same gains and income would be taxed over and above an individuals other income. They haven’t announced that these trusts will be disallowed but they are going to be consulting with the industry and examining the ability to use these structures in the future. It is expected that there will not be any immediate phase out and that existing trusts may have their tax treatment extended for some time. In any event, this was not good news for Canadians with larger estates who want their families to benefit from lower tax rates on inherited funds.

There were a few positive developments as well but most of them were, in my opinion, fairly minor. If you have any questions about the recent, as well as proposed, changes and how they might affect your investments or estate plans, do not hesitate to get in touch.

Changes to the Old Age Security Program

As you may have heard, recent measures have been taken to ensure the longevity to the Old Age Security Program. The OAS program is the single largest federal revenue program.

As you know, we are living longer lives and in 2030 it is projected that there will be twice as many people receiving OAS than there is today. In light of this, the government felt changes to the program, to defer eligibility for future recipients, were regrettably necessary.

This change will be gradual and increases the age of eligibility of these benefits. The following is a quick summary of what this means for you!

If you were born in 1957 or earlier you are still eligible for OAS at age 65.

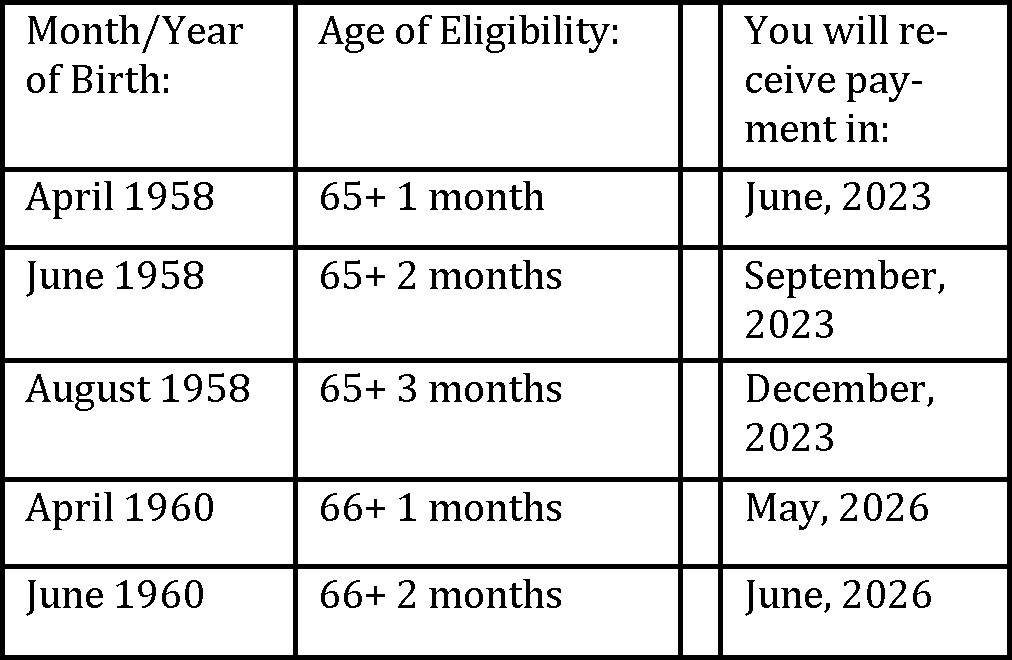

If you were born between April 1st, 1958 and January 1st 1962 a pre-determined number of months gets added to your eligibility age as per the charts found on the government websites.

If you were born in February 1962 or later you will not receive any OAS until the age of 67.

The formula is 1 month in deferred OAS for every 2 months after April 1958 that you were born. A few examples are below: (note; under the current rules the first payment is already one month after your birth date)

Follow us on Twitter!

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Insurance products, including segregated fund policies are offered through Trinity Wealth Partners Inc., and Rick Irwin offers mutual funds through Quadrus Investment Services Ltd.

The information provided is based on current tax legislation and interpretations for Canadian residents and is accurate to the best of our knowledge as of the date of publication. Future changes to the tax legislation and interpretations may affect this information. This newsletter contains general information only and is intended for informational and educational purposes provided to clients of Rick Irwin, CFP, CLU. While information contained in this newsletter is believed to be reliable and accurate at the time of printing, Rick Irwin does not guarantee, represent or warrant that the information contained in this newsletter is accurate, complete, reliable, verified or error-free. This newsletter should not be taken or relied upon as providing legal, accounting or tax advice. Prospective investors should review the offering documents relating to any investment carefully before making an investment decision and should ask their advisor for advice based on their specific circumstances. You should obtain your own personal and independent professional advice, from your lawyer and/or accountant, to take into account your particular circumstances. Quadrus Investment Services Ltd. and design, Quadrus Group of Funds and Fusion are trademarks of Quadrus Investment Services Ltd. Used with permission.